"Life is uncertain.

But your family's future doesn't have to be."

Understand the importance of life insurance and how it can protect what matters most.

What is life insurance?

Why Does It Matter?

Life is unpredictable.

But the impact of your absence doesn’t have to be.

Life insurance is more than just a policy — it’s a promise of protection, peace of mind, and dignity for the people you love most. It’s your way of saying, “Whatever happens, I’ve got you.”

Why Life Insurance is Essential

Whether you're a parent, a breadwinner, an OFW, a business owner, or someone just starting out life insurance helps you:

✅ Replace lost income for your family

✅ Pay off debts and final expenses

✅ Fund your child’s education even if you're not around

✅ Ensure a comfortable retirement

✅ Leave a lasting legacy, not a financial burden

Who Needs Life Insurance?

Everyone who has people depending on them needs life insurance. Especially if:

You have young children or elderly parents

You’re the main provider of the household

You’re building a future with your partner

You want to be prepared for life’s uncertainties

Common Misconceptions About Life Insurance

Many Filipinos delay getting life insurance because of myths and misunderstandings. From thinking it's only for the rich, to believing it's useless if nothing happens — these misconceptions can put your future at risk.

In this section, we’ll debunk the most common myths about life insurance and help you see why getting protected is more important (and affordable) than you might think.

“Bata pa ako, di ko pa kailangan niyan.”

👉 Truth: The younger and healthier you are, the cheaper your premium. Starting early gives you more coverage at a lower cost.

“Mahal ‘yan, pang-mayaman lang.”

👉 Truth: Life insurance is more affordable than most people think. There are plans for every budget — even as low as ₱800/month.

“Wala naman akong sakit, bakit ako kukuha?”

👉 Truth: That’s exactly when you should get insured — while you’re still healthy. Insurance companies may decline applications if you develop illnesses later.

“Hindi ko naman makikinabang diyan.”

👉 Truth: Life insurance isn’t just for death benefits. Many plans offer living benefits — like critical illness coverage, savings, retirement fund, or cash value you can use in the future.

“Sapat na ang SSS o company insurance ko.”

👉 Truth: Company benefits usually stop when you resign or retire. And SSS may not be enough to cover your family’s needs.

“Kapag hindi ako namatay, sayang lang binayad ko.”

👉 Truth: Some insurance plans have return of premium, savings components, or investment value — so you still benefit even if nothing happens.

“May ipon naman ako, di ko na kailangan niyan.”

👉 Truth: Ipon can easily be wiped out by medical emergencies or sudden loss. Insurance is a financial back-up that protects your savings.

“Hindi ko alam paano simulan, masyadong komplikado.”

👉 Truth: That’s why financial advisors like me exist — to explain, guide, and help you choose a plan that fits your life and goals.

“Matagal pa ang retirement, saka na lang.”

👉 Truth: The earlier you start preparing, the less you need to pay and the more you’ll have later on. Time is your greatest asset.

“Wala akong anak o asawa, di ko kailangan.”

👉 Truth: Life insurance isn't just for family people. It’s for anyone who wants to:

✅ Protect their future income

✅ Leave a legacy

✅ Cover final expenses

✅ Gain peace of mind

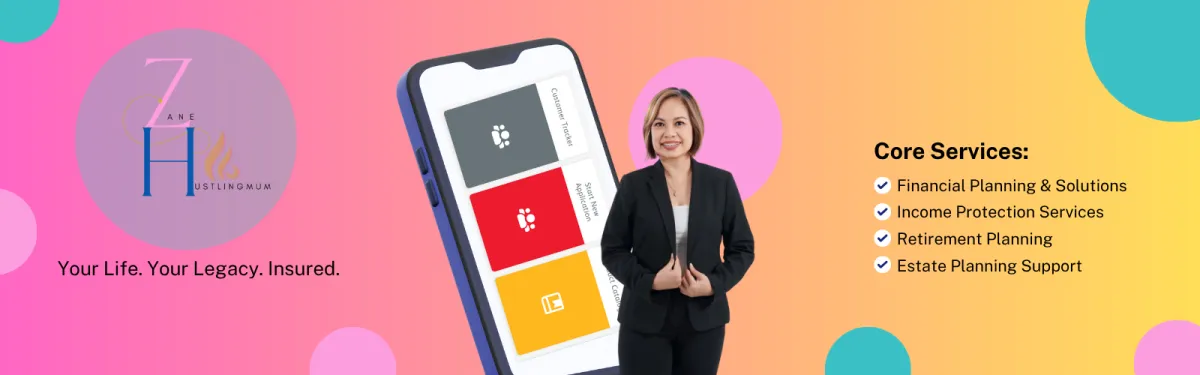

From financial protection to future planning

see how I can guide you every step of the way

Disclaimer: This website is for informational purposes only and does not constitute an official offer of insurance. All proposals are subject to underwriting and approval.

© 2025 Jesuzzane | All rights reserved.